Talking Points on Illicit Financial Flows and Tax Justice

-

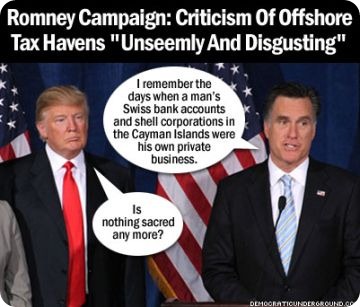

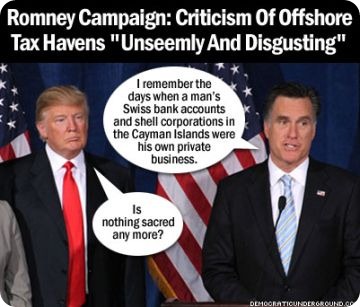

Inequality and tax evasion are growing both

within and between countries, while the rich on all continents funnel

their wealth into secret bank accounts scattered around the world.

This erodes the public sector, starves countries of funds needed

for development, and drives up deficits.

-

The trend is worldwide as multinational companies shuttle money and

subsidiaries between countries to minimize taxes, while the ultra-rich and organized crime hide their assets in untraceable shell accounts. But the toll in Africa is enormous, with losses estimated at $50 billion to $80 billion a year due to illicit capital flight.

-

One recent study, for example, estimated at least US$60.8 billion in losses due to transfer pricing in or out of 5 African Countries (Ghana, Kenya, Mozambique, Tanzania, and Uganda), from 2002-2011.

-

The good news is that governments and multilateral agencies around

the world are waking up to this issue, and the pressure for transparency

in financial reporting is growing. The same technical mechanisms that

have been used to track funds of drug traffickers and terrorist networks can now be used, if there is political will, to track

monies lost to illicit financial flows and tax evasion.

|

|