|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

Africa/Global: The Future's Not in Plastics

AfricaFocus Bulletin

October 13, 2020 (2020-10-13)

(Reposted from sources cited below)

Editor's Note

“The petrochemical industry is already facing record-low plastic

feedstock prices as a result of massive overcapacity. And yet, it

plans to expand supply for virgin plastics use by a quarter at a

cost of at least $400 billion in the next 5 years, risking huge

losses for investors. The plastics industry is a bloated behemoth,

ripe for disruption. … Meanwhile, 36% of plastic is used only

once, 40% ends up polluting the environment and less than 10% is

actually recycled.” - Carbon Tracker Initiative

As demand for oil declines, “the oil industry is pinning its hopes

on strong plastics demand growth that will not materialise, as the

world starts to tackle plastic waste and governments act to hit

climate targets,” according to this new report from the Carbon

Tracker Initiative. But instead of adjusting to the new reality,

oil and petrochemical industry lobbyists continue to press for

government action to continue to profit, despite the consequences

of further global warming and environmental damage.

A new report from Greenpeace reveals that “a lobby group

representing oil and chemical companies, including Shell, Exxon,

Total, DuPont and Dow, has been pushing the Trump administration

during the pandemic to use a US-Kenya trade deal to expand the

plastic and chemical industry across Africa.”

Ironically, the industry's strategic plan would make Kenya, a

leader in banning plastic bags, into the African hub for plastic

waste exported from industrialized countries.

This AfricaFocus Bulletin contains press releases from the Carbon

Tracker Initiative and Greenpeace, with links to the full reports.

The full reports are available respectively at

https://carbontracker.org/oil-industry-betting-future-on-shaky-plastics-as-world-battles-waste/ and

https://unearthed.greenpeace.org/2020/08/30/plastic-waste-africa-oil-kenya-us-trade-deal-trump/.

For previous AfricaFocus Bulletins on the climate and environment, visit http://www.africafocus.org/intro-env.php

++++++++++++++++++++++end editor's note+++++++++++++++++

|

The Future’s Not in Plastics: Why plastics demand won’t rescue the oil sector

$400 billion of planned petrochemical outlay at risk on exaggerated plastics demand

Carbon Tracker Initiative, 04 September 2020

https://carbontracker.org/oil-industry-betting-future-on-shaky-plastics-as-world-battles-waste/

Key Quotes

“Remove the plastic pillar holding up the future of the oil

industry, and the whole narrative of rising oil demand collapses.”

Kingsmill Bond, Carbon Tracker Energy Strategist and report lead

author.

“There are huge benefits in the change from the current linear

system to a more circular one. You can have all the functionality

of plastics but at half the capital cost, half the amount of

feedstock, 700,000 additional jobs and 80% less plastic pollution.”

Yoni Shiran, lead author of Breaking the Plastic Wave

“It is simply delusional for the plastics industry to imagine that

it can double its carbon emissions at the same time as the rest of

the world is trying to cut them to zero,” Kingsmill Bond.

$400 billion of planned petrochemical outlay at risk on exaggerated

plastics demand

London/New York, September 4 – The oil industry is pinning its

hopes on strong plastics demand growth that will not materialise,

as the world starts to tackle plastic waste and governments act to

hit climate targets. This risks $400 billion worth of stranded

petrochemical investments, increasing the likelihood of peak oil

demand, finds a new report from Carbon Tracker, basing some of its

findings on a recent report “Breaking the Plastic Wave”.

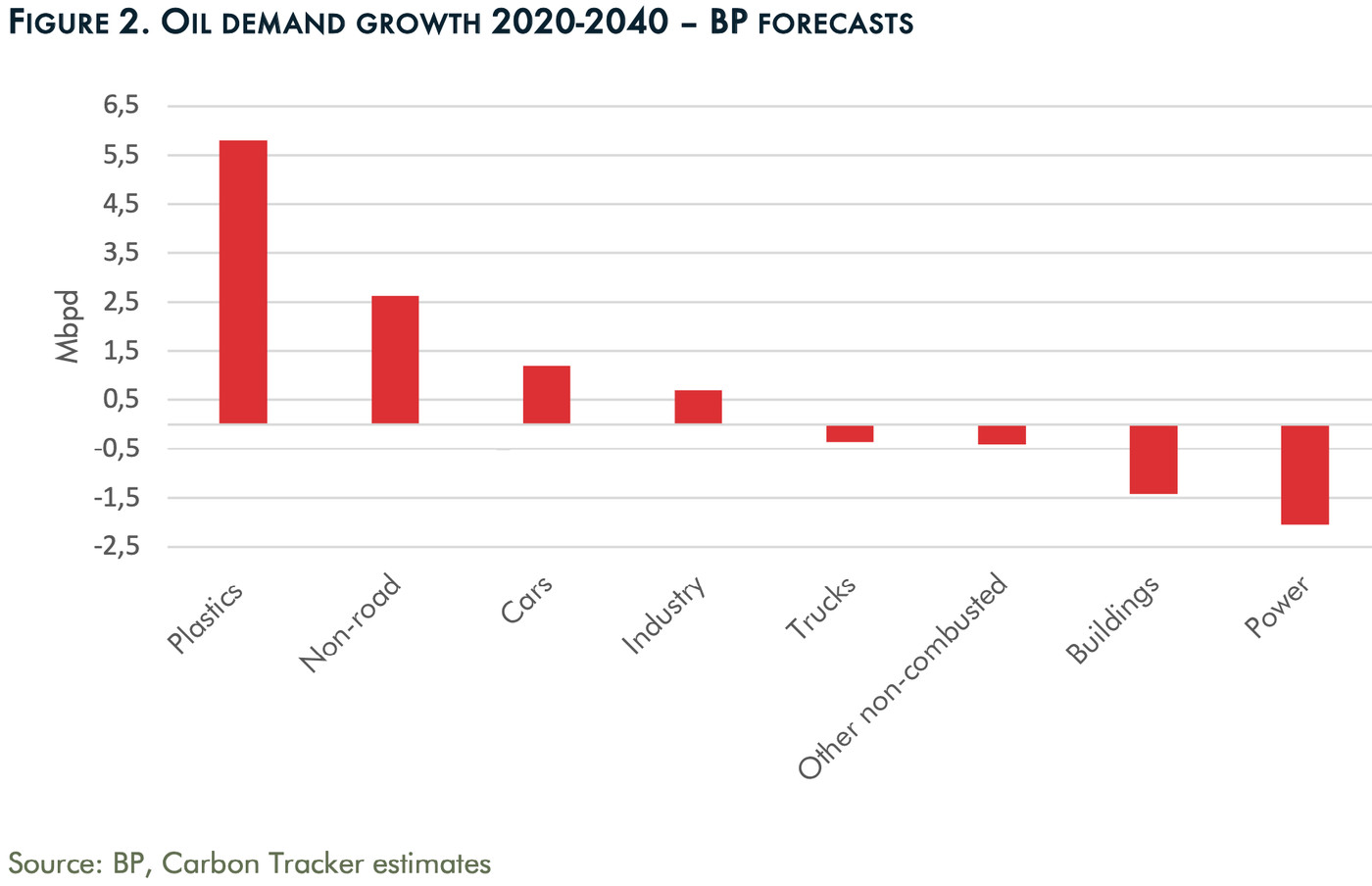

The central scenarios of BP and the IEA imply that plastics demand

will be the largest driver of oil demand growth, making up 95% and

45% of growth to 2040 respectively, as oil demand is challenged in

its core area of transport.

The Future’s Not in Plastics finds that mounting pressure to

curtail the use of plastics – now a worldwide public concern [

IPSOS polls carried out in 2019 in 28 countries found 70-80% of

those polled wanted action on waste including a ban on single use

plastics and forcing manufacturers to pay for recycling costs]

– could slash virgin plastic demand growth from 4% a year to under

1%, with demand peaking in 2027.

The implication for big oil is that the industry will lose its

primary growth driver, making it more likely oil demand peaked as

early as 2019.

“Remove the plastic pillar holding up the future of the oil

industry, and the whole narrative of rising oil demand collapses.”

- Kingsmill Bond, Carbon Tracker Energy Strategist and report lead

author.

The petrochemical industry is already facing record-low plastic

feedstock prices as a result of massive overcapacity. And yet, it

plans to expand supply for virgin plastics use by a quarter at a

cost of at least $400 billion in the next 5 years, risking huge

losses for investors.

The plastics industry is a bloated behemoth, ripe for disruption.

Plastics imposes an externality cost on society of at least $1,000

per tonne, or $350 billion a year, from emitting carbon dioxide,

associated health costs from noxious gases, collection costs and

the alarming growth in ocean pollution.

And yet it receives more in subsidy than it pays in taxation, and

until recently there have been very few constraints on how you can

use plastics. Meanwhile, 36% of plastic is used only once, 40% ends

up polluting the environment and less than 10% is actually

recycled.

SYSTEMIQ notes that technology solutions are already available to

enable a massive reduction in plastic usage at lower cost than

business as usual. Solutions include reuse, with better design and

regulation of product, substitutions such as paper, and a large

increase in recycling.

“There are huge benefits in the change from the current linear

system to a more circular one. You can have all the functionality

of plastics but at half the capital cost, half the amount of

feedstock, 700,000 additional jobs and 80% less plastic pollution.”

-- Yoni Shiran, lead author of Breaking the Plastic Wave and

analyst at SYSTEMIQ.

Policymakers in Europe and China are already taking steps to clamp

down on plastics waste and have a wide range of tools they can use,

from regulation and bans to taxes, targets and recycling

infrastructure.

The EU for example in July 2020 proposed an €800/t tax on

unrecycled waste plastic, while China has similar regulatory

aspirations and has started to ban certain types of plastic. In

China the first major flag came in 2018 when the country largely

closed down its industry for importing and processing plastic waste

– the world’s largest – forcing exporters to solve the waste issue

at home.

The report notes a stagnation in demand in developed markets and a

leapfrog in emerging markets. As has been seen in other areas of

the energy system, OECD plastic demand is stagnating at the same

time as emerging market leaders are looking for alternative

solutions to plastic.

A further critical element that will dim the rosy petrochemical

demand picture painted by incumbents is the effects of global

policy action to tackle climate change. Carbon dioxide is produced

at every stage of the plastic value chain – including being burnt,

buried or recycled, not just extraction of oil and manufacturing.

The analysis therefore finds that plastic releases roughly twice as

much CO2 as producing a tonne of oil.

If one assumes 350Mt of plastic demand with a total carbon

footprint of around 5 tonnes of CO2 per tonne of plastic, that

implies 1.75Gt of CO2. Continuation of current growth rates would

see the carbon footprint of plastics double by the middle of the

century to around 3.5Gt. And yet, the Paris Agreement implies that

global CO2 emissions (33Gt from the energy sector in 2018) will

have to halve by 2030 and get to zero by the middle of the century.

“It is simply delusional for the plastics industry to imagine that

it can double its carbon emissions at the same time as the rest of

the world is trying to cut them to zero,” Kingsmill Bond.

The report can be downloaded here: https://carbontracker.org/reports/the-futures-not-in-plastics/

About Carbon Tracker

The Carbon Tracker Initiative is a not-for-profit financial think tank that seeks to promote a climate-secure global energy market by aligning capital markets with climate reality. Our research to date on the carbon bubble, unburnable carbon and stranded assets has begun a new debate on how to align the financial system with the energy transition to a low carbon future. http://www.carbontracker.org

*******************************************************************

Oil-backed trade group is lobbying the Trump administration to push

plastics across Africa

https://unearthed.greenpeace.org/2020/08/30/plastic-waste-africa-oil-kenya-us-trade-deal-trump/

The American Chemistry Council also pushed back against new global

rules that will restrict the flow of plastic waste to the global

south

30.08.2020

Emma Howard

A lobby group representing oil and chemical companies, including

Shell, Exxon, Total, DuPont and Dow, has been pushing the Trump

administration during the pandemic to use a US-Kenya trade deal to

expand the plastic and chemical industry across Africa.

Documents obtained by Unearthed show the same lobby group – and the

US recycling industry – also lobbied against changes to an

international agreement that puts new limits on plastic waste

entering low- and middle-income countries.

Several of the companies in the American Chemistry Council (ACC) –

including Shell, Exxon and Total but not BP – were the founders of

a $1bn initiative that pledges to create “a world free of plastic

waste”.

In public letters to top officials at the US Trade Representative

and US International Trade Commission, the ACC writes: “Kenya could

serve in the future as a hub for supplying U.S.-made chemicals and

plastics to other markets in Africa through this trade agreement.”

Kenya's ban on plastic bags in 2017 made it one of the world

leaders in combating this environmental pollution. Credit: United World Project.

The letters also call for the lifting of limits on the waste trade,

a move which experts say amounts to an attempt to legally

circumvent the new rules on plastic waste, rules which – the

documents reveal – the firms had also vigorously opposed.

Kenyan environmentalists said the proposals would mean that “Kenya

will become a dump site for plastic waste”.

US Democratic Senator Tom Udall, who last year introduced

legislation to tackle the plastic waste crisis accused the

companies of “double dealing.”

He told Unearthed: “It is outrageous that petrochemical and plastic

industries claim the solution to our mounting plastic waste crisis

is to produce more disposable plastic. These same companies and

corporations then point the finger at developing nations for the

plastic waste showing up in our oceans. This double-dealing makes

clear what the true source of our plastic waste crisis is:

companies and corporations off-shoring their responsibilities to

make billions of dollars… Requiring these companies to take

responsibility for their excessive waste and pollution is the only

way we will tackle our colossal plastic waste problem.”

The ACC is a major trade association for chemical companies,

including Dow and DuPont, as well as the petrochemical arms of some

of the oil majors. Although BP is a member, it does not produce any

plastics and last month sold off its petrochemicals business to

Ineos. A spokesperson told Unearthed that their work with the ACC

focuses on Castrol lubricants, which are used in the automotive

industry.

Basel Convention

Following public outcry about plastic waste, in May last year, new

rules agreed under a global treaty called the Basel Convention mean

that as of 2021, almost all countries outside the OECD will be

prohibited from trading mixed, contaminated or unrecyclable plastic

with the US, because it is one of the few countries not party to

the Convention.

The OECD has not yet ruled on whether it will accept the new

plastic waste rulings, following objections from the US. The Basel

Convention provides a limited exception which would allow continued

trade between the US and the 37 member countries of the OECD, but

only if those countries adopt standards on plastic waste as strong

as those in the Convention.

The 187 countries that are part of the treaty will have to partake

in a procedure to obtain prior informed consent from importing

countries, a procedure which requires checks on environmental

processing facilities.

Unpublished documents obtained by Unearthed under the Freedom of

Information Act (FOIA) show that the oil and chemical industry

lobby group wrote to the Secretariat of the Basel Convention in

March 2019.

It objected to the new rules on the basis that they would create a

“regulatory burden”, lead to shipping delays, logistical issues and

increased costs. It forwarded its letter to the Office of the US

Trade Representative (USTR) two weeks later, requesting a meeting

to discuss its concerns.

The documents also reveal that the Institute of Scrap Recycling

Industries (ISRI) – a major trade association representing the US

recycling industry – lobbied against the new rules on the basis

that they could severely limit US exports, discourage legitimate

trade and exacerbate marine litter by preventing plastic from

reaching recycling facilities.

“In principle, we would prefer the proposals not be adopted and

maintain the status quo,” they wrote in an email sent to USTR on 3

April 2019.

A spokesperson from the ACC told Unearthed the basis of their

concerns regarding the new Basel restrictions was that they “could

very well limit the ability of African and other developing

countries to properly manage plastic waste,” because they will

restrict their capacity to export materials to other countries.

ISRI echoed these concerns. A spokesperson told Unearthed that the

new restrictions “will prevent countries that lack materials

management infrastructure – such as for collection, sorting and

recycling – from sending what they can collect to countries that do

have recycling and disposal capacity… Without this outlet for

developing countries, ISRI worries that an already bad situation

will become much worse.”

According to ISRI, in 2018 the US imported more than 92,000 metric

tons of plastic waste from non-OECD countries.

However, in the first six months of that year, US exports to China,

Hong Kong, India, Malaysia, Thailand and Vietnam alone – all

countries outside the OECD – totalled 480,432 tons. These exports

are five times the US imports in half the time.

The Trump administration backed the industry position – opposing

the implementation of the new rules at the OECD. US opposition has

led to concerns over whether the country will seek ways around the

changes.

This trade deal would diminish what we have achieved as a country

Dr. Innocent Nnorom, an associate professor in environmental

chemistry at Abia State university in Nigeria, who co-authored a

recent inventory of plastic consumption in Africa, told Unearthed:

“Most countries in Africa do not have the recycling infrastructure

for managing increasing plastic waste.

“It appears that loopholes are being sought to continue the trade

in plastic waste. Once in Africa, the emerging free trade routes

could be used to facilitate transboundary movements to other

African countries. The African Union and its member states should

be on the look-out.”

Demand for petrochemicals is expected to rocket in coming decades,

with companies expected to be looking to low- and middle-income

countries to expand the market. Plastic is already the US’ biggest

export to Kenya, with sales totalling $58m in 2019.

In their letters to the Trump administration regarding the US-Kenya

FTA earlier this year, the ACC called for it to “prohibit

imposition of domestic limits on production or consumption of

chemicals and plastic and restrictions on cross-boundary trade of

materials and feedstocks”. Feedstocks could include plastic waste

for recycling.

They added that the US and Kenya should “enable trade in waste for

the purposes of sound management and recycling consistent with

relevant international commitments”.

Even so, David Azoulay, an attorney and director of the

environmental health programme at the Center for International

Environmental Law told Unearthed: “The suggestion to use this

potential agreement to preempt any national limitation on plastic

production and consumption is a clear indication of the ACC’s

objective to leverage such a trade agreement to circumvent global

efforts to curb plastic production and use, as well as newly

adopted provisions from the Basel Convention to better control the

global plastic waste trade.”

Jim Puckett, executive director of the NGO Basel Action Network

commented that it would also contradict the Bamako Convention, a

separate treaty in Africa.

“The effort to enlarge trade in waste and harmful chemicals in

between the US and Kenya is a rather insidious effort that, if

taken across Africa would go head to head against Africa’s Bamako

Convention – a treaty which prohibits virtually all plastic waste

imports into Africa as well as the import of many hazardous

chemicals,” he told Unearthed.

Kenya

Environmentalists are concerned the deal could also undermine

national efforts to limit plastic consumption, including new rules

on plastic bags.

Sub-Saharan Africa is thought to lead the world on plastic bag

laws, according to reports, with 34 countries adopting taxes or

bans.

Dorothy Otieno, the plastics programme co-ordinator at the Centre

for Environment, Justice and Development (CEJAD) in Kenya, told

Unearthed that this trade deal could threaten the momentum and

change created by these efforts.

“As a country we have made strides to reduce the plastics that are

used here, and which end up as waste – there is a ban on use and

manufacture of carrier bags and recently a ban on plastic in

protected areas – so this trade deal would diminish what we have

achieved as a country.”

But Kenyan politicians and trade groups said such fears will be

addressed. Negotiations began several weeks ago, but have recently

stalled due to coronavirus concerns.

Cornelly Serum, an MP for the ruling Jubilee Party and member of

the Trade and Industry Parliamentary Committee, told Unearthed:

“Fears that under the trade deal use of plastics might be

reintroduced into the country are valid… Trade associations

planning to expand their businesses in Africa – and mainly in Kenya

– are welcome but cannot use the deal to introduce materials that

have so far been banned and as a parliament we will not allow any

protocols likely to ruin our economy.”

Carol Karuga, CEO of broad-based lobby group the Kenya Private

Sector Alliance, added: “It does not augur well to ban use of

plastics materials in the economy and later reintroduce the same

through a trade deal… The deal before it is finally agreed will

have to be checked at all levels.”

Otieno also expressed concerns about the impact of more waste.

“There would be an increase in waste – some will be reused and

recycled but the majority will end up in dump sites. We will end up

in a situation where Kenya will become a dump site for plastic

waste,” she said.

“It clogs our waterways and our drainage systems and leads to

flooding. We also see the effect of pollution from the burning of

plastics – it produces dioxins and furans that lead to respiratory

diseases… Somebody can burn these wastes right next to your house

and suffer the impacts. We also see the aesthetic value of our

towns being reduced because of plastics.”

Last year, some of the ACC companies – including Shell, Exxon and

BASF – alongside major consumer goods and waste management

companies launched the Alliance to End Plastic Waste (AEPW),

committing $1bn, in part to finance waste management projects to

clean up and prevent plastic waste in Africa and Asia.

In the public letters, the ACC wrote that: “There is a global need

to support infrastructure development to collect, sort, recycle,

and process used plastics, particularly in developing countries

such as Kenya.

“Such infrastructure will create opportunities for trade and

investment and help keep used plastics out of the environment,

thereby reducing marine litter… The U.S. and Kenya can play a

strong role together in promoting innovative circular economy

solutions in East Africa that enable universal access to better

waste management capacity and for used plastics in all countries.”

The ACC argued in the documents obtained through FOIA that such

infrastructure will require the continuation of the plastic waste

trade and that the new rules could “slow efforts to address the

marine litter challenge” because a circular economy requires ample

feedstock.

“Increased barriers on global plastics trade will lead to increased

burdens on local plastic waste management, regardless of whether

the sourcing country has adequate domestic recycling

infrastructure,” they argued.

A spokesperson from the ACC told Unearthed that their concerns were

regarding how the restrictions could impede exports from low- and

middle-income countries to those with more infrastructure capacity.

The correspondence with the US government references both exports

and imports.

The documents also suggest that the US government supported the

AEPW. An official at USTR accepted an invitation from the ACC to an

event on the alliance in April 2019, responding that “what you are

doing with the Alliance is an important counter-narrative”.

A spokesperson from Shell told Unearthed: “Shell companies

participate in industry associations for many reasons. By nature

they are consensus-based organisations, but their positions don’t

necessarily reflect the same views as individual members. ACC is

one of a handful of US-based trade organizations that allows Shell

to exchange industry best practices around a range of issues,

including safety, climate change, and the sustainable use, disposal

and recycling of the products we collectively produce.”

Total referred us to their report on climate change, which states

that Total is “partially aligned” with the ACC’s position on

climate, but which makes no mention of plastics.

Exxon, DuPont, Dow and BASF referred us to the ACC for comment. The

US International Trade Commission, which is an independent federal

agency, told us it does not participate in trade negotiations and

referred us to USTR for comment. USTR has not responded to our

request.

A version of this article was published in the New York Times.

****************************************************************

AfricaFocus Bulletin is an independent electronic publication

providing reposted commentary and analysis on African issues, with

a particular focus on U.S. and international policies. AfricaFocus

Bulletin is edited by William Minter. For an archive of previous Bulletins,

see http://www.africafocus.org,

Current links to books on AfricaFocus go to the non-profit bookshop.org, which supports independent bookshores and also provides commissions to affiliates such as AfricaFocus.

AfricaFocus Bulletin can be reached at africafocus@igc.org. Please

write to this address to suggest material for inclusion. For more

information about reposted material, please contact directly the

original source mentioned. To subscribe to receive future bulletins by email,

click here.

|