|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

Africa/Global: Debt, IFFs, and Inequality in Africa

AfricaFocus Bulletin

May 11, 2022 (2022-05-11)

(Reposted from sources cited below)

Editor's Note

“43 African governments are facing expenditure cuts totalling $183 billion

(equivalent to 5.4 percent of GDP) over the next five years, reveals new

analysis from Oxfam and Development Finance International (DFI) today. If

these cuts are implemented, their chances of achieving the UN’s Sustainable

Development Goals will likely disappear.” - Oxfam International and

Development Finance International

This AfricaFocus Bulletin contains key excerpts from this new briefing paper published on April 19, 2022. The full paper, available at https://panafrica.oxfam.org/latest/policy-paper/africas-extreme-inequality-crisis-building-back-fairer-after-covid-19, provides an analysis linking internal inequality between rich and poor within Africa with the global economic and political structures which helped create such a system and continue to help keep it in place.

The paper also includes, as most other such international reports, a set of

recommendations which can be seen as only an utopian wishlist. Alternatively,

they may be taken as long-rang goals on which action is both urgently required

and becoming more feasible as more information is pried from offshore secrecy

by investigators and momentum for action grows as the tax justice movement in

Africa and around the world increases its capacity for coordination and

political influence.

The report continues by noting that “Africa’s debt burden is stifling post-

COVID economic recovery and stagnating the public services necessary to reduce

poverty and inequality. Africa’s debt burden has been climbing steadily,

averaging 67 percent of GDP in 2021. Debt repayments are equivalent to 51

percent of African countries’ budget revenue and 22 times more than their

spending on social protection. Debt servicing exceeds spending on healthcare

in all but six African countries, rising to 77 times more in South Sudan. The

G20 countries have so far offered little relief: debt cancellation or

suspension amounts to just $9.3 billion.”

It also cites the responsibility of both African and global governments and

international agencies to take action to stem the system of illicit financial

flows and tax evasion/avoidance that perpetuates the debt.

Also included are links selected by the editor to other related material available online immediately below this paragraph. That is followed by a section highlighting recommended books, drawn from the AfricaFocus affiliate page on bookshop.org (https://bookshop.org/shop/africafocus). Bookshop.org is a registered B Corporation (https://www.bcorporation.net/en-us/)which shares its surplus above costs and reinvestment in the site with independent bookstores. Affiliates include authors, organizations, and online publications such as AfricaFocus as well as independent bookstores who may set up their own pages on the site.

+++++++++++++++++++++++++++++++++++++++++++++++++

Editor's Picks

https://africanarguments.org/2022/04/austerity-is-not-the-answer-to-africas-colliding-challenges/

A useful short article summarizing the Oxfam/DFI report.

https://www.worldpoliticsreview.com/articles/30516/by-hiking-interest-rates-fed-dooms-the-developing-world

“It’s a widely acknowledged truth that when the United States’ economy sneezes, many countries catch a cold. And so it is with this week’s interest rate hike by the Federal Reserve in Washington, whose efforts to contain inflation in the U.S. are sure to create new problems for already battered economies and families in less affluent countries.”

https://fpif.org/the-united-states-of-tax-havens/

My article from November 3, 2021

“There are many ways in which the United States is not one country.

I’m not referring to the electoral reality of red states versus blue states,

or to the split between a radicalized Republican Party and those of us who

hope that an inclusive democratic vision of the nation might eventually

prevail. Nor am I speaking here of racial or ethnic divisions, however

defined.

Rather, what I mean is that the United States, where countless corrupt

billionaires and dictators have stashed their loot, is not a single tax haven,

but many separate tax havens.”

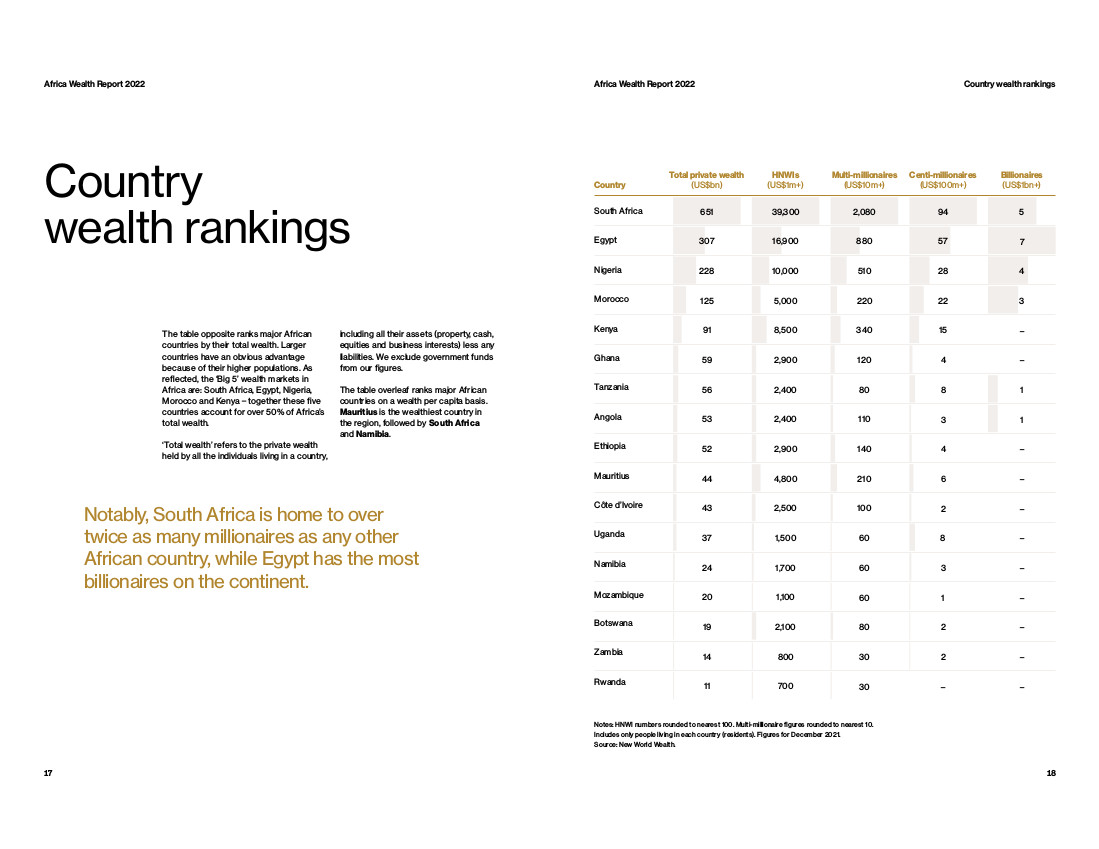

https://www.henleyglobal.com/publications/africa-wealth-report-2022

Fascinating 40-page report from an investment-advice company.

“The Africa Wealth Report is published by Henley & Partners, the global leader

in residence and citizenship by investment, in partnership with South African

wealth intelligence firm New World Wealth.

https://www.pewresearch.org/race-ethnicity/2022/04/14/race-is-central-to-identity-for-black-americans-and-affects-how-they-connect-with-each-other/

Pew Survey Report on Black American Opinions

Very detailed 90-page report on survey, including immigrants from the

Caribbean and Africa and both Hispanic and non-Hispanic respondents. Also

includes links to methodology.

“The online survey of 3,912 Black U.S. adults was conducted Oct. 4-17, 2021.

The survey includes 1,025 Black adults on Pew Research Center’s American

Trends Panel (ATP) and 2,887 Black adults on Ipsos’ KnowledgePanel.

Respondents on both panels are recruited through national, random sampling of

residential addresses.” . . .

“No matter where they are from, who they are, their economic circumstances or

educational backgrounds, significant majorities of Black Americans say being

Black is extremely or very important to how they think about themselves, with

about three-quarters (76%) overall saying so.” . . .

“Finally, Black Americans were asked about how connected they felt to Black

people around the world. About four-in-ten (41%) say everything or most things

that happen to these Black people impact their own lives. Immigrant (41%) and

U.S.-born (41%) Black adults are about as likely to hold this view. So are

non-Hispanic (41%), multiracial (35%) and Hispanic (38%) Black adults.

However, Black adults who say that being Black is very or extremely important

to them (48%) are more than twice as likely as those for whom being Black is

less important (18%) to say what happens to Black people around the world

affects what happens in their own lives.”

https://oxford.universitypressscholarship.com/view/10.1093/oso/9780198852728.001.0001/oso-9780198852728-chapter-7

Open-access. Concluding chapter from the new book by Léonce Ndikumana and James K. Boyce: On the Trail of Capital Flight from Africa: The Takers and the Enablers.

“This book investigates the dynamics of capital flight from Angola, Côte

d’Ivoire, and South Africa, countries that have witnessed large-scale illicit

financial outflows in recent decades. Quantitative, qualitative, and

institutional analysis for each country is used to examine the modus operandi

of capital flight; that is, the “who,” “how,” and “where” dimensions of the

phenomenon. “Who” refers to major domestic and foreign players; “how” refers

to mechanisms of capital acquisition, transfer, and concealment; and “where”

refers to the destinations of capital flight and the transactions involved.

The evidence reveals a complex network of actors and enablers involved in

orchestrating and facilitating capital flight and the accumulation of private

wealth in offshore secrecy jurisdictions. This underscores the reality that

capital flight is a global phenomenon, and that measures to curtail it are a

shared responsibility for Africa and the global community. Addressing the

problem of capital flight and related issues such as trade misinvoicing, money

laundering, tax evasion and theft of public assets by political and economic

elites will require national and global efforts with a high level of

coordination.”

++++++++++++++++++++++end editor's note+++++++++++++++++

|

Books Recommended by AfricaFocus Bulletin

https://bookshop.org/lists/stop-the-bleeding-illicit-financial-flows-and-tax-justice/

The AfricaFocus Bookshop on bookshop.org contains multiple lists of books read

and/or recommended by the editor on a variety of subjects, including books on

African and global issues, mystery novels, and books of possible interest

picked up at the numerous Little Free Library boxes in the Mount Pleasant

neighborhood. Purchasing your books here is the best way to support the

ongoing work of AfricaFocus, as AfricaFocus is no longer actively seeking

voluntary subscription payments as contributions paid by check or Paypal.

The links in the AfricaFocus shop can only be used for books to be sent to mailing addresses in the United States. But many of the same books can be bought on https://uk.bookshop.org/ to be sent to mailing addresses in the United Kingdom. For AfricaFocus subscribers in other countries, please check with the publisher or with bookstores or distributors in your country. And, of course, you may also check with friend, colleague, or comrade to see if they can get the book for you.

The four highlighted below are, in my opinion, most useful as first books to

read for the non-specialist for their clear writing and analysis, even though

the first two were written approximately a decade ago.

Tax Us If You Can is also available in PDF format at https://www.taxjustice.net/cms/upload/pdf/tuiyc_africa_final.pdf

and at https://taxjusticeafrica.net/wp-content/uploads/2019/06/Tax-Us-If-You-Can-Why-Africa-should-Stand-up-for-Tax-Justice.pdf.

Demands for austerity and spiralling debt are ‘sabotaging’ Africa’s COVID-19 recovery

April 19, 2022

https://panafrica.oxfam.org/latest/policy-paper/africas-extreme-inequality-crisis-building-back-fairer-after-covid-19

43 African governments are facing expenditure cuts totalling $183 billion

(equivalent to 5.4 percent of GDP) over the next five years, reveals new

analysis from Oxfam and Development Finance International (DFI) today. If

these cuts are implemented, their chances of achieving the UN’s Sustainable

Development Goals will likely disappear.

The Commitment to Reducing Inequality Index: Africa Briefing Paper shows that

Africa’s debt burden is stifling post-COVID economic recovery and stagnating

the public services necessary to reduce poverty and inequality. Africa’s debt

burden has been climbing steadily, averaging 67 percent of GDP in 2021. Debt

repayments are equivalent to 51 percent of African countries’ budget revenue

and 22 times more than their spending on social protection. Debt servicing

exceeds spending on healthcare in all but six African countries, rising to 77

times more in South Sudan. The G20 countries have so far offered little

relief: debt cancellation or suspension amounts to just $9.3 billion.

‘‘Majority of African governments know and want to lift their citizens from

poverty but their coffers are empty, so they need support instead of more

pressure,’’ said Peter Kamalingin, Oxfam’s Pan Africa Program director. ‘‘At a

time when poor countries are faced with increasing costs of living and with

poor people unable to afford food, it cannot be the time to suffocate them

with more austerity. That is the surest way to undermine recovery, widen

inequality and destroy livelihoods.’’

The index ranks 47 African countries on their policies on public services, tax

and workers’ rights. South Africa ranks first, followed by Seychelles,

Tunisia, Namibia and Lesotho. At the bottom are South Sudan, Nigeria, Chad,

Liberia and the Central African Republic. North Africa outperforms Africa’s

other subregions, with Central Africa ranking last.

The analysis shows that African governments’ failure to tackle inequality --

through support for public healthcare and education, workers’ rights and a

fair tax system -- left them woefully ill-equipped to tackle the COVID-19

pandemic. The IMF has contributed to these failures by consistently

pushing a policy agenda that seeks to balance national budgets through cuts to

public services, increases in taxes paid by the poorest, and moves to

undermine labour rights and protections. As a result, when COVID-19 struck,

52 percent of Africans lacked access to healthcare and 83 percent had no

safety nets to fall back on if they lost their job or became sick.

Quality public services are proven to reduce inequality. For example, they

have reduced inequality by 34 percent in Namibia, 22 percent in South Africa

and 19 percent in Benin. However, Africa’s unfair tax system is increasing

inequality by 1 percent. In Tanzania and Tunisia, fair tax policies have

slashed inequality by 10 percent.

Oxfam and DFI are urging the G20 to reallocate and waive off unnecessary

conditionalities so that lower-income countries can access most of the $100

billions worth of IMF Special Drawing Rights (SDRs) with ease. They are

calling for increased aid flows to Africa to increase access to inequality-

busting public services and COVID-19 vaccines. The vaccination rate in Africa

needs to increase significantly if the continent is to meet the 70 percent

vaccine coverage target set for June 2022.

‘‘That some governments have fared better than others at tackling inequality

confirms we can end inequality if we make the right policy decisions. This

must include taxing the wealthiest, curbing illicit financial flows,

restructuring debt held by poor countries and ending the pandemic through

equitable access to COVID-19 Vaccines and therapeutics.’’ - Peter Kamalingin.

ENDS

Notes to editors

Download Oxfam’s Commitment to Reducing Inequality Index: Africa.

Our analysis of the IMF’s COVID-19 loans during the first year of the pandemic is also available for download.

Contact information: Victor Oluoch in Kenya victor.oluoch@oxfam.org

Africa’s Extreme Inequality Crisis: Building Back Fairer after Covid-19

https://panafrica.oxfam.org/latest/policy-paper/africas-extreme-inequality-crisis-building-back-fairer-after-covid-19

Introduction

Africa is facing a crisis of extreme inequality which is undermining growth,

preventing poverty eradication and contributing to insecurity. The six

richest African billionaires are now wealthier than the poorest 50% of

Africans combined. This briefing paper shows that COVID-19 has deepened this

crisis, and that the responses of African governments and international

financial institutions are making little difference as debt burdens grow and

austerity kicks in. While some African governments were doing a lot to fight

inequality before COVID-19, through equitable public services, progressive

taxation and enhanced labour rights, especially for women, most were not. The

paper lays out a comprehensive plan of measures which could be taken by

African governments, the AU and the international community, including the EU,

to significantly reduce inequality,eradicate poverty, accelerate growth, and

reduce insecurity throughout Africa.

Executive summary

Africa’s Crisis of Inequality, Debt and Adjustment

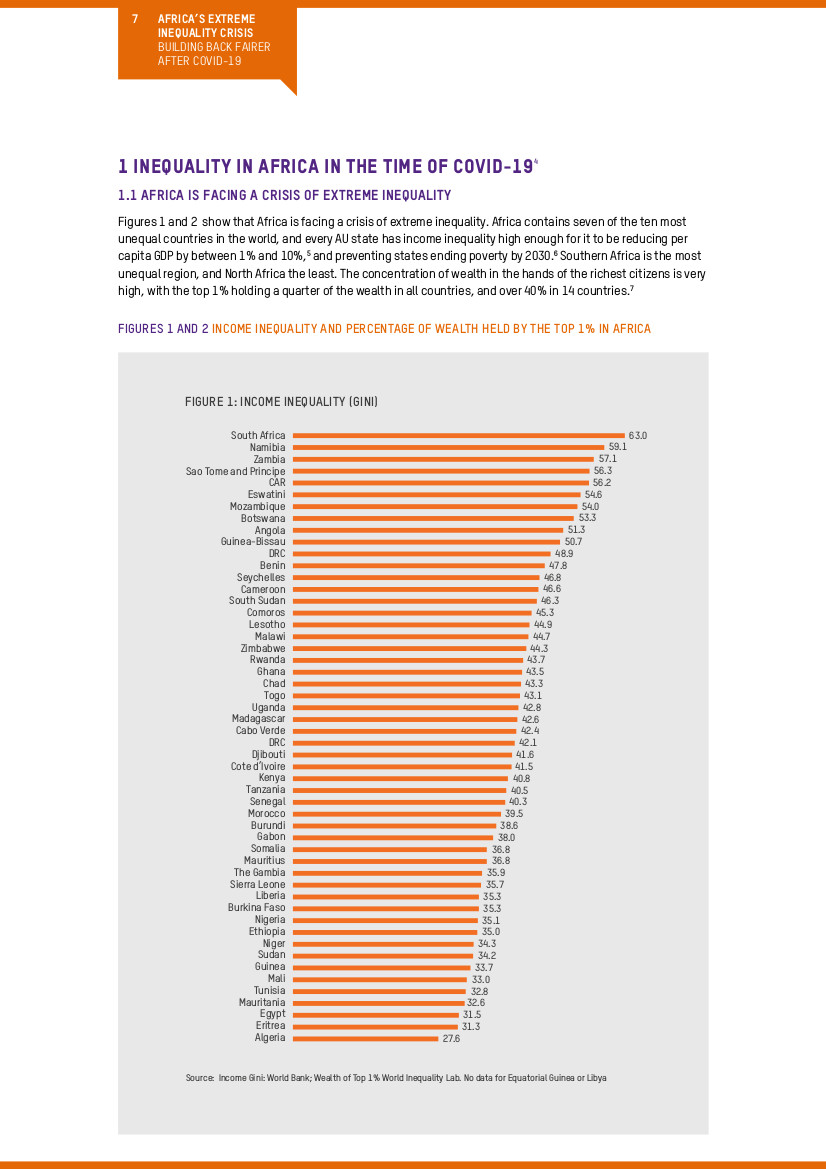

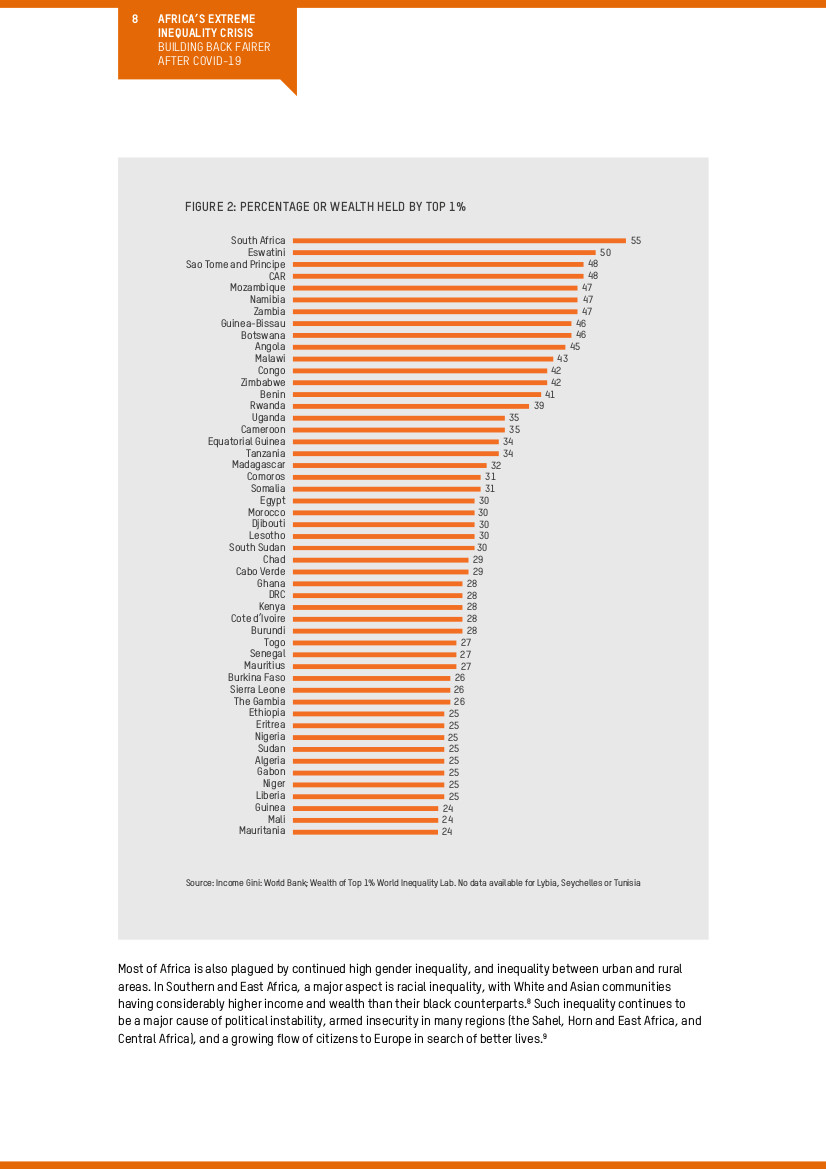

Africa is facing a crisis of extreme inequality: seven of the ten most unequal

countries in the world are in the region; inequality is undermining growth in

every African Union member state; and the top 1% of Africans hold 33% of

Africa’s wealth. Such inequality is a major cause of political instability and

insecurity.

The COVID-19 pandemic has dramatically increased poverty and inequality, such

that the six richest Africans now own more wealth than the poorest 50%

combined. As a result, without accelerated efforts to reduce inequality, it

will be impossible to end extreme poverty in Africa by 2030.

Africa was poorly prepared to face a pandemic, with 52% of its citizens

lacking access to healthcare, 83% lacking access to social protection and 52%

of workers having no formal labour rights. Unequal access to vaccines (11% of

Africans have been vaccinated by early February, compared with 71% of

Europeans) means that Africans are more likely to die from COVID-19.

African governments made valiant attempts to respond to COVID-19, but most

lacked affordable finance so as to increase spending sharply – low-income

countries spent only 3.1% of GDP and emerging markets 5.3% of GDP, compared

with 19.1% for OECD economies. Much of this went towards healthcare and social

protection, but most African governments are now phasing out these measures,

leaving no long-term increases in healthcare or social protection spending to

fight future pandemics.

Africa’s debt burden has risen sharply before and during COVID-19: debt

servicing is almost three times as much as education spending, six times

health spending, 22 times social spending and 236 times more than climate

adaptation spending. To repay debts and reduce budget deficits, the IMF is

encouraging most countries to implement austerity: 43 AU member states will

cut their spending by a cumulative 5.4% of GDP in 2021–26, totalling $183bn.

This confirms earlier Oxfam findings, which showed that in 2020-21 the Fund

had encouraged 33 African countries to pursue austerity policies.1

What Can Be Done about This Crisis?

The key government policies which reduce inequality are: universal free

education and health services and social protection; equitable taxation; and

enhanced labour rights, especially for women. Development Finance

International and Oxfam International have designed a Commitment to Reducing

Inequality (CRI) Index to track progress on these policies and their impact

across 158 countries, including 47 in Africa.2

The latest CRI Index report finds that North Africa outperforms other regions

in Africa, with Central Africa lagging behind. The African countries that

fare better are South Africa and the Seychelles, but they score only 0.75,

meaning that they could do one-third more to match the best global performers.

Lesotho comes in the top five, showing that lower-income countries can

perform well. The poorest performers are South Sudan, Nigeria, Chad, Liberia

and the Central African Republic.

On public services, many African countries allocate high proportions of their

budgets to education, but most fall way below AU or global targets for

education, health, social protection and agriculture spending. Because

amounts spent per capita are low, education, health and social protection do

not reach the poorest people. Across Africa, social spending reduces

inequality by only 7.8%, compared with 8.5% in Asia and 10% in Latin America:

however, Namibia (34%), South Africa (22%) and Benin (19%) stand out for using

social spending to cut inequality.

Africa does better on equitable taxation, because its tax systems are

progressive on paper, with many countries having high top personal and

corporate income tax rates, and VAT exemptions for food. However, Africa

collects only 29% of the taxes implied by its tax rates, 10% behind other

developing regions, because of high levels of tax exemptions and tax dodging.

Taxes on wealth, capital gains, inheritances and property are also weak. As a

result, tax in Africa is actually increasing inequality by 1% – though

Tanzania and Tunisia have used tax to cut inequality by 10%.

The worst African performance is on labour rights. Though many aspects of

policy look good on paper, some countries repeatedly violate labour rights,

lack laws or enforcement of women’s labour rights, and have very low minimum

wages. Above all, 67% of Africa’s workers are unemployed, underemployed or in

jobs without formal contracts, leading Africa to have the highest wage

inequality of any developing region.

This briefing paper presents a set of key recommendations to African

governments, the AU Commission and the international community on the urgent

measures they can take to cut inequality in Africa, thereby eradicating

poverty, accelerating growth and reducing insecurity and migratory pressures.

Conclusion and Recommendations

There is nothing inevitable about the crisis of extreme inequality in Africa, nor its worsening during the COVID-19 pandemic. However, without concerted efforts by governments and support from the international community, the crisis will deepen, and stop the region from meeting the SDGs. The pandemic must serve as a wakeup call to national, regional and global leaders for an inclusive recovery that tackles inequality aggressively. In spite of strong anti-inequality efforts by some governments in the region, market-produced inequality due to poor labour rights and unequal access to land and credit have kept inequality far too high. The efforts of many other African governments to tackle inequality are far short of what is needed, and in fact are increasing inequality in many cases. Only immediate measures to reverse pandemic-related rises in inequality, strongly reinforced national commitment to anti-inequality policies, and regional and international support, can allow African countries to emerge from the pandemic without a major increase in inequality and poverty – and resume their progress to meeting the SDGs.

1. The Most Urgent Recommendations

• Ensuring COVID-19 vaccines for all African countries, to reach 70% vaccine

coverage by June 2022, in line with the global WHO goal.

• Immediately reversing the planned fiscal austerity, with a particular

emphasis on increasing spending for health, education and social protection

to achieve the SDGs.

• These enhanced spending efforts should be funded by:

- increasing rates and collection of progressive income and wealth taxes in

each country.

- cancelling debt service due to all creditors between 2022 and 2025.

- reallocating $100bn of SDRs to low-income developing countries (LIDCs) as

grants. If additional loans are to be offered, they should be highly

concessional loans with minimal or no conditionality; and

- increasing aid flows to Africa targeted at enhancing anti-inequality social

spending.

• Mandating the IMF and World Bank to ensure that all country programmes and

policy advice focus on reducing inequality, and contain specific urgent

measures to make tax, public services and labour policies achieve this more

effectively.

2. Key Recommendations for African Governments

Across the continent, it is vital for national governments to build post-COVID

recovery plans, including:

A. Spend much more on universal high-quality public services that reduce the

gap between rich and poor people

• Allocate 20% of government budgets to free universal pre-primary, primary

and secondary education.

• Allocate 15% of government budgets to fund free public universal healthcare

without patient fees of any kind.

• Provide universal social protection programmes including, for example, for

the working poor, children, people living with disabilities, unemployed

people and other vulnerable groups, including pensioners.

• Allocate 10% of budgets to enhanced investment in smallholder food-producing

agriculture.

• Increase investment in water, sanitation and hygiene so as to ensure

universal access and coverage.

B. Redistribute income and wealth through progressive taxation

• Make corporate and personal income taxes more progressive

• Introduce or strengthen taxes on wealth, capital gains, property, and

financial transactions and income.

• Ensure all value added and general sales taxes exempt basic food products.

• Ensure multinational corporations pay their fair share of taxes by

strengthening anti-tax avoidance policies.

• Scrap unnecessary tax exemptions for corporations and richer individuals,

and review tax treaties to ensure that they support revenue generation and

do not give away taxing rights unnecessarily.

• Strengthen the capacity of national revenue authorities to curb illicit

financial flows, through corporate country-by-country reporting and

exchanging data on profits and wealth holdings.

• Invest in strengthened tax administrations’ compliance efforts that are

targeted at high-income earners and corporations.

C. Strengthen labour policies and rights, especially for informal, vulnerable

and unemployed workers

• Ensure workers have rights to unionize, strike and bargain collectively, in

line with ILO conventions.

• Legislate in all countries against gender discrimination, rape and sexual

harassment, and for equal pay.

• Increase parental leave and expand paternity leave significantly to reduce

the burden of unpaid care on women.

• Increase minimum wages to match per capita GDP.

• Invest far more in national structures enforcing labour legislation,

including encouraging the informal sector to progressively comply with laws

and provide social protection to their workers.

• Invest in public sector jobs and public works to cut unemployment, and

increase unemployment benefits.

3. Recommendations for AU Leaders and the AU Commission

The mandate of the African Union in Vision 2063 includes poverty eradication,

which cannot be achieved without reducing inequality sharply. In addition,

the AU theme for 2022 is ‘Food Security to Strengthen Agriculture, and

Accelerate Human Capital, Social and Economic Development’. In this context,

the AU should put reducing inequality at the heart of its work from 2022

onwards, by:

A. Recognizing and planning to remedy AU member states’ extreme inequality

crisis

• Prioritize tackling inequality in the agendas of summits, ministerial

meetings and the Secretariat.

• Develop a joint continental action plan to set clear targets and accelerate measures to reduce inequality and poverty.

• Establish a robust mechanism to support and monitor the achievement of SDG

10 on reducing inequality.

B. Encouraging ‘a race to the top’ in policies to reduce inequality

• Enhance the roles of regional commissions (EAC, ECOWAS, SADC, WAEMU) in

advising members on coordinating tax policies, by building regional tax

harmonization frameworks, involving more progressive income taxes and VAT,

and strengthened taxes on capital gains, property, financial income and

wealth.

• Seek regional harmonization of investment and tax codes to curb harmful tax

competition in the region, particularly by sharply limiting tax incentives.

• Develop common regional frameworks on measures to combat tax dodging and

illicit financial flows, including corporate country-by-country tax reporting

and information exchange on bank accounts.

• Enhance monitoring of compliance with AU norms on spending on education,

health, social protection and agriculture, and extend this to assess coverage

of public services for people living in poverty.

• Develop and monitor compliance with regional norms on labour policies

designed to reduce inequality, such as union rights, women’s rights, minimum

wages and policies to encourage job formalization.

4. Recommendations For The EU And The International Community

The international community should support national and regional efforts by:

• Mandating the IMF and World Bank to ensure that all AU country strategies,

programmes and policy advice focus on reducing inequality, and contain

specific measures to achieve this more effectively.

• Immediately reverse opposition to the TRIPS waiver on all COVID-19 vaccines,

treatments and technologies, and support the mandatory sharing of vaccine

recipes by pharmaceutical corporations, including sharing MRNA technologies

with the WHO MRNA hub in South Africa.

• Supporting the rapid scaling up of publicly controlled vaccine production

facilities across the continent.

• Providing comprehensive debt cancellation to AU countries where needed, to

reduce their debt servicing to low levels and ensure that they have enough

financing to achieve the SDGs.

• Establishing a global fund for social protection that supports lower-middle-

and low-income countries to provide social protection for all by 2030.

• Introducing solidarity taxes in their own countries on wealth, income,

carbon emissions and financial transactions, with part of the revenue going

to lower-income countries.

• Assisting developing countries to collect more taxes by reversing the global

‘race to the bottom’ on corporate tax rates, sharing corporate country-by-

country tax reporting information and information on global bank accounts,

and ending tax treaties which reduce tax collection.

• Ensuring that all global tax reforms provide a fair share of their benefits

to developing countries, by making all profits taxed where they have been

created, through a process where developing countries are equally

represented.

• Ensuring that climate policies do not harm low-income countries.

Specifically, the EU should consider an exclusion of least developed

countries (LDCs) from the Carbon Border Adjustment Mechanism (CBAM) and use

the revenues from the CBAM to increase support for climate action in low-

income countries.

• The EU should not pressure African countries to implement the recent OECD

tax deal (BEPS 2), nor penalise countries that did not endorse it, by

blacklisting them in the EU tax havens list. The EU should allow countries to

carefully consider the trade-offs in the deal and the best course of action

for them, including the use of unilateral measures such as digital service

taxes or alternative minimum taxes. If African countries agree to the OECD

tax deal, the EU should support them to implement it in a way that is more

convenient for them, and EU countries should renegotiate bilateral tax

treaties with low taxation levels, as provided for in the deal.

• The EU must live up to its rhetoric of a ‘partnership of equals’ with the AU

and support national and regional efforts by prioritising reducing inequality

in all its national-level policy dialogue with African countries, and in its

collective and member state interventions in IMF and World Bank governing

bodies. It could also, where requested by African governments, provide

capacity building assistance to help countries design and implement equitable

spending and progressive tax policies, and to enhance labour rights in order

to reduce inequality sharply – which would help them eradicate poverty, and

dramatically accelerate GDP growth between now and 2030.

AfricaFocus Bulletin is an independent electronic publication

providing reposted commentary and analysis on African issues, with

a particular focus on U.S. and international policies. AfricaFocus

Bulletin is edited by William Minter. For an archive of previous Bulletins,

see http://www.africafocus.org,

Current links to books on AfricaFocus go to the non-profit bookshop.org, which supports independent bookshores and also provides commissions to affiliates such as AfricaFocus.

AfricaFocus Bulletin can be reached at africafocus@igc.org. Please

write to this address to suggest material for inclusion. For more

information about reposted material, please contact directly the

original source mentioned. To subscribe to receive future bulletins by email,

click here.

|